Western Europe right now…

Western Europe is facing a reckoning. The continent that once dictated terms to the world now finds itself navigating a minefield of fiscal constraints, demographic challenges, and geopolitical irrelevance. The post-war consensus that delivered prosperity for decades has collapsed, and what we're witnessing is a collection of nations trying to maintain living standards with economic models that no longer function. Some are adapting, most are flailing, and a few are simply pretending the problem doesn't exist. For investors, understanding these national trajectories isn't academic speculation, it's essential for positioning capital in a fragmenting global order.

The United Kingdom sits precariously close to requiring an IMF bailout, or as they'd probably prefer to call it, a "financial assistance package." They're burning through money as if the East India Company still exists and the crown jewels haven't been pawned yet. The fiscal situation is dire, with debt servicing costs eating into any productive spending, and the political class seemingly incapable of making hard choices. What's worse is that living standards have been falling for seventeen years straight. Think about that timeline: an entire generation has experienced nothing but economic stagnation and declining purchasing power. The social cohesion that once defined British society is fracturing visibly. The immigration policy, driven by a utopian worldview that prioritized sentiment over pragmatism, has created tensions that politicians are now scrambling to manage. Brexit was supposed to be liberation, but instead it left the UK alone, bitter, and strategically adrift. There's little room left to maneuver financially, and the options narrow further every quarter.

France faces similar fiscal pressures with an even higher debt-to-GDP ratio than Britain, making an IMF intervention (or as the French might euphemistically term it, a "massage économique") a real possibility. The social fabric here holds together slightly better, perhaps because the French never bothered learning English or because the Mediterranean weather keeps spirits higher than in foggy London. But make no mistake, France is bitter. They've effectively lost the Sahel, which means the old post-colonial arrangement where Paris maintained influence through military presence and economic extraction has evaporated. No more safaris for French mining executives. The one thing France retains is military capability. They're the only European country with genuine power projection capacity, nuclear weapons, and a defense industry that isn't entirely dependent on American technology transfers. That capability gives them options other European nations simply don't have, even if their economic fundamentals are deteriorating.

Germany's situation is perhaps the most intellectually interesting because it represents the complete failure of an optimization strategy. For decades, the German economic model worked brilliantly: cheap Russian energy, free American defense spending, and open access to Chinese and global markets for exports. They optimized every variable in this equation, building an industrial base that hummed along with ruthless efficiency. Now all three pillars have collapsed simultaneously. Russian gas is gone, American defense guarantees are increasingly conditional, and Chinese markets are both more competitive and less accessible. Germany has lower debt-to-GDP than France or the UK, which provides a cushion, but that cushion only buys time to finance current living standards, not to restructure the economy. They can afford to splurge for maybe a decade before reality forces painful adjustments. The tragedy is that because they spent so long optimizing for the old model, there's minimal slack in the system to pivot toward something new. Export-led growth was their best bet, and that bet is losing.

Italy is experiencing something unexpected: a mini-revival. After suffering through years of stagnation, political instability, and being the perpetual sick man of Europe, Italy is having a relatively good moment. Milan is quietly becoming more important as a financial center, attracting capital and talent fleeing London's post-Brexit uncertainty and its increasingly hostile regulatory environment. The irony of Italian banks and financial firms gaining ground while British institutions lose relevance would have seemed absurd a decade ago, but here we are. The problem, as always with Italy, is the debt burden. They're heavily indebted with limited fiscal space to sustain this positive momentum. This relatively good period is fragile and probably temporary. There's simply no room to finance an extended recovery without either significant structural reforms (unlikely given Italian political dynamics) or external support (which comes with conditions Rome won't want to accept).

Spain occupies an interesting position in this European landscape. Yes, it has low wages, high debt, and stubbornly high unemployment, but Spain also benefits from geographic distance from major conflict zones and a certain cultural resilience to economic hardship. The Spanish armed forces are essentially drinking wine with jamon rather than preparing for any serious military contingency, which tells you everything about how seriously Spain takes geopolitical threats. But here's where Spain has been quietly shrewd: immigration policy. While other European nations bungled integration or created parallel societies, Spain has attracted significant talent from Latin America. Shared language and cultural affinity made this natural, and the result is that some of the best minds from across the Atlantic are choosing Barcelona and Madrid over Paris or London. This talent influx won't solve Spain's structural economic problems, but it does provide human capital that other aging European societies desperately need.

The Netherlands presents a fascinating case study in reaching systemic limits. They've built a GDP of 1.2 trillion euros on what is essentially a swamp. The density of economic activity per square meter is extraordinary, but that's precisely the problem: they've literally run out of land. There's nowhere left to expand, no room to build, and the country is bumping against hard physical constraints that most nations never encounter. They've optimized their tiny territory about as much as optimization allows. Adding to the absurdity, there's an almost religious obsession with reducing livestock, particularly cows, in what can only be described as a woke-ist ritual divorced from practical agricultural or economic considerations. The Dutch are wealthy, efficient, and trapped by their own success in a territory that cannot accommodate further growth without radical reimagining of what the Netherlands actually is.

Luxembourg exists in a category of its own, a financial services platform masquerading as a country. The entire economy is basically sleeping, in the sense that it's a passive vehicle for capital flows, tax optimization, and holding company structures. Luxembourg performs its function adequately: facilitating European corporate structures and providing a stable jurisdiction for fund domiciliation. But there's nothing particularly dynamic or innovative happening. It's a well-run machine that does exactly what it's designed to do, no more, no less. For investors, Luxembourg is plumbing, essential infrastructure that you never think about until it breaks.

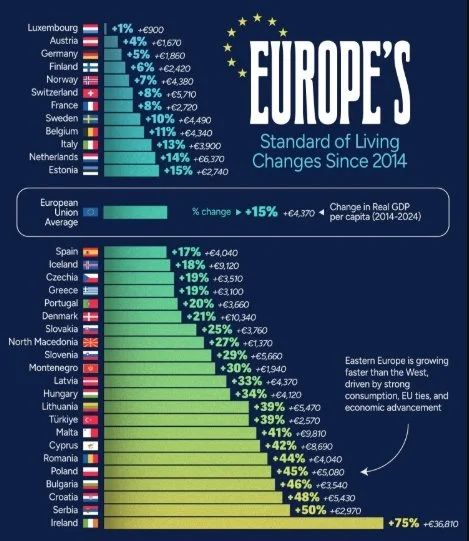

The broader picture across Western Europe is one of nations trapped between past glory and present constraints, unable to generate the growth necessary to maintain social peace and living standards. The fiscal space to address problems has narrowed dramatically, demographic trends are unforgiving, and the geopolitical environment is increasingly hostile. Some countries have more runway than others, some are adapting better to new realities, but none have discovered a sustainable model for prosperity in this changed world. For those of us allocating capital, this European stagnation isn't a temporary phase to wait out, it's a structural condition that will define investment returns for the next decade.